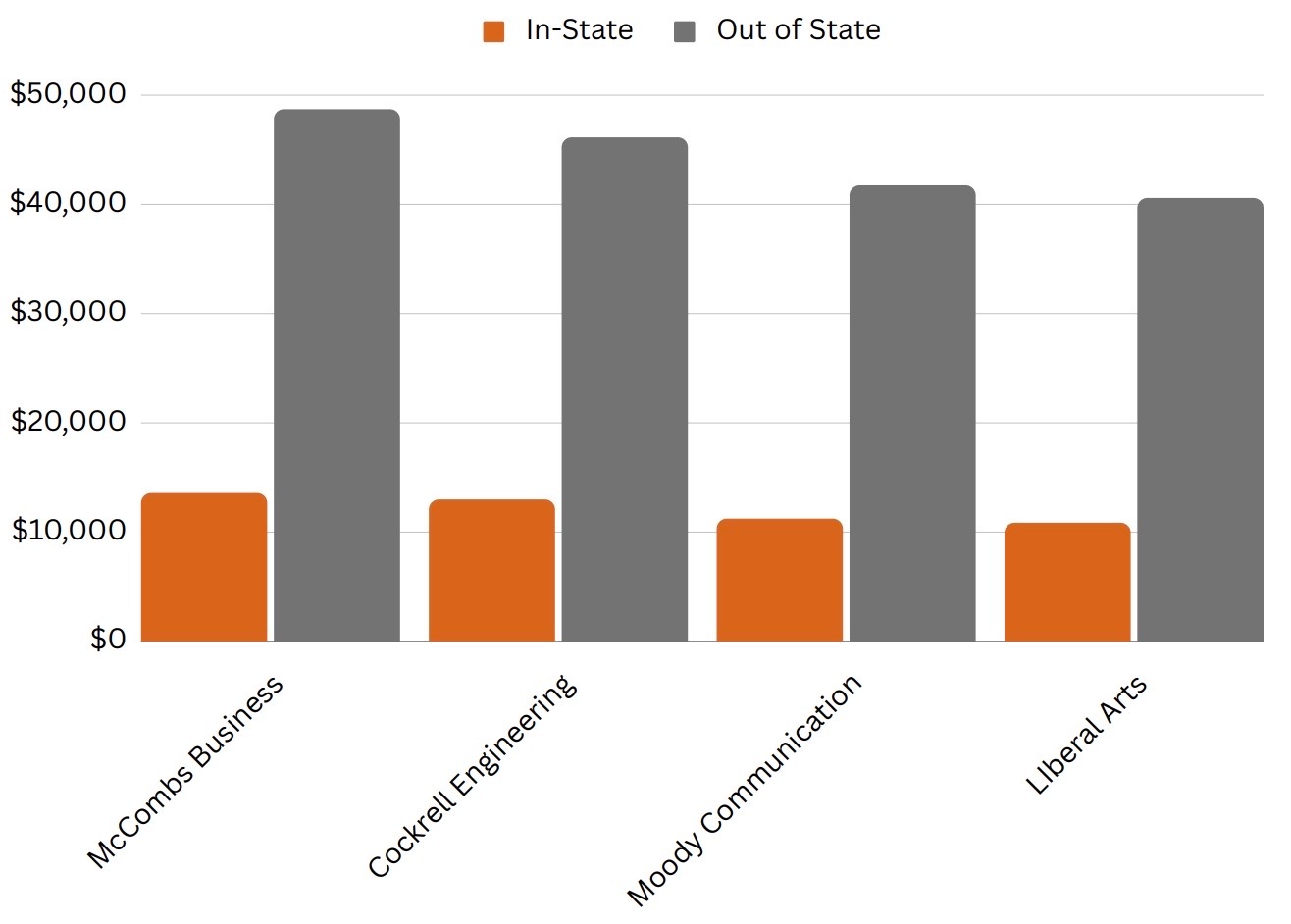

UT Austin In-State Tuition

Investing in real estate at the University of Texas at Austin offers savings on tuition of up to $100,000 as well as gains on the underlying asset.

Reach out today with any and all questions and our team would be ecstatic to go through a free, no commitment consultation with you and your family!

Out of State Students pay 3.6x more for tuition than Texas residents.

Benefits of UT Austin Real Estate Investment

Tax Benefits

Tax benefits are often overlooked in rental investment analyses. The interest payments you make on your mortgage every month can be used as a write-off to reduce your taxable income. Furthermore, the depreciation you can claim can also contribute you our efforts in helping you keep your hard earned money. We include these two features in our underwriting and even calculate your capital gains tax and depreciation recapture at the disposition of the condo many years down the road.

If you would like to learn more about these strategies, feel free to get in contact and we can go over all this in detail with you.

In-State Tuition savings

By owning property in Texas and paying in-state tuition rates, you stand to save north of $30,000 on tuition annually. These savings can approach $100,000 over the course of your student's time at UT. The sooner we act, the more semesters we can take advantage of this reduced tuition rate!

Peace of Mind

If you want to have more peace of mind over your student's living accommodations, this can be a great way to accomplish this noble goal. You can pick out a nice condo or an affordable one, and can have your Longhorn stay there/ rent it with their buddies for all 4 years if you'd like!

Cash Flow Potential

The UT Austin area has hundreds of properties and there is potential for a monthly cash flow from this investment. Austin has property prices that are high compared to monthly market rents, but the UT area can offer a unique pocket of cash flow opportunities due to the rooms being separately leasable. Downpayments in the 40% + range would cashflow much more easily than a typical 20% for investments, and we can run all the numbers specific to you and your goals.

Tax Benefits

Tax benefits are often overlooked in rental investment analyses. The interest payments you make on your mortgage every month can be used as a write-off to reduce your taxable income. Furthermore, the depreciation you can claim can also contribute you our efforts in helping you keep your hard earned money. We include these two features in our underwriting and even calculate your capital gains tax and depreciation recapture at the disposition of the condo many years down the road.

If you would like to learn more about these strategies, feel free to get in contact and we can go over all this in detail with you.

In-State Tuition savings

By owning property in Texas and paying in-state tuition rates, you stand to save north of $30,000 on tuition annually. These savings can approach $100,000 over the course of your student's time at UT. The sooner we act, the more semesters we can take advantage of this reduced tuition rate!

Peace of Mind

If you want to have more peace of mind over your student's living accommodations, this can be a great way to accomplish this noble goal. You can pick out a nice condo or an affordable one, and can have your Longhorn stay there/ rent it with their buddies for all 4 years if you'd like!

Cash Flow Potential

The UT Austin area has hundreds of properties and there is potential for a monthly cash flow from this investment. Austin has property prices that are high compared to monthly market rents, but the UT area can offer a unique pocket of cash flow opportunities due to the rooms being separately leasable. Downpayments in the 40% + range would cashflow much more easily than a typical 20% for investments, and we can run all the numbers specific to you and your goals.

Tax Benefits

Tax benefits are often overlooked in rental investment analyses. The interest payments you make on your mortgage every month can be used as a write-off to reduce your taxable income. Furthermore, the depreciation you can claim can also contribute you our efforts in helping you keep your hard earned money. We include these two features in our underwriting and even calculate your capital gains tax and depreciation recapture at the disposition of the condo many years down the road.

If you would like to learn more about these strategies, feel free to get in contact and we can go over all this in detail with you.

Why Invest in THIS Market Specifically?

Low Volatility in Asset Valuation

Student housing is a lot more like commercial real estate than it is residential. It is primarily an investment vehicle after all! Commercial assets are valued on their rental income, which is much more robust in student housing than it is for other areas of town. Strong demand and stable fund sources support this trend of continued increases in rent.

Low Vacancy

There are over 50,000 students at the University of Texas and they need housing. For this reason, the campus area enjoys a very low vacancy rate. The campus area also boasts a quicker transition from tenant to tenant. The traditional lease cycle ends July 31 and begins again August 7-15, with many properties enforcing an "installment" rental schedule. This means that the month of August is NOT prorated, and this essentially makes the vacancy 0% for underwriting purposes.

At Longhorn Condos, we still use a 5% vacancy rate to underwrite deals because we take a conservative approach to all we do!

Extensive Marketing

There is a longer window of time that we can use to advertise the properties in the campus area than any other part of town. Your unit can get tours and applications started as early as 9 months in advance (Prelease starts in November for the move ins the following August!)

This contributes massively to the reduction in vacancies and increased opportunity of securing a lease at top dollar rates!

Low Default Rate

Students are almost always going to use a guarantor (usually a parent) when signing a lease in the campus area. This will mean that the risk of financial default is very low. Furthermore, many students use federal financial aid to pay for rent, making this one of the safest investments you can make!

Low Volatility in Asset Valuation

Student housing is a lot more like commercial real estate than it is residential. It is primarily an investment vehicle after all! Commercial assets are valued on their rental income, which is much more robust in student housing than it is for other areas of town. Strong demand and stable fund sources support this trend of continued increases in rent.

Low Vacancy

There are over 50,000 students at the University of Texas and they need housing. For this reason, the campus area enjoys a very low vacancy rate. The campus area also boasts a quicker transition from tenant to tenant. The traditional lease cycle ends July 31 and begins again August 7-15, with many properties enforcing an "installment" rental schedule. This means that the month of August is NOT prorated, and this essentially makes the vacancy 0% for underwriting purposes.

At Longhorn Condos, we still use a 5% vacancy rate to underwrite deals because we take a conservative approach to all we do!

Extensive Marketing

There is a longer window of time that we can use to advertise the properties in the campus area than any other part of town. Your unit can get tours and applications started as early as 9 months in advance (Prelease starts in November for the move ins the following August!)

This contributes massively to the reduction in vacancies and increased opportunity of securing a lease at top dollar rates!

Low Default Rate

Students are almost always going to use a guarantor (usually a parent) when signing a lease in the campus area. This will mean that the risk of financial default is very low. Furthermore, many students use federal financial aid to pay for rent, making this one of the safest investments you can make!

Low Volatility in Asset Valuation

Student housing is a lot more like commercial real estate than it is residential. It is primarily an investment vehicle after all! Commercial assets are valued on their rental income, which is much more robust in student housing than it is for other areas of town. Strong demand and stable fund sources support this trend of continued increases in rent.

Lease With Ease | 2505 San Gabriel St. Austin, TX 78705 | 737.377.4277 | Not affiliated to the University of Texas Austin